limited pay life policy coverage

A 40-year-old male will pay around 17225 per year on a 10 pay policy with 500000 coverage. All whole life insurance is designed to reach maturity at the insureds age.

Limited Pay Life Insurance Everything You Need To Know

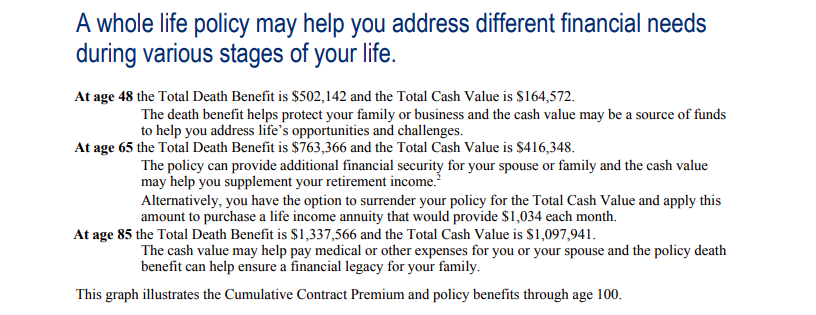

Since the purpose of a whole life insurance policy is to offer coverage for the lifetime of the insured your family can be secured under the policy until you are 100 years of age.

. A limited pay life policy could solve this problem for many but its not the right solution for everyone. What is an example of limited pay life policy. However there is a more nuanced version of this.

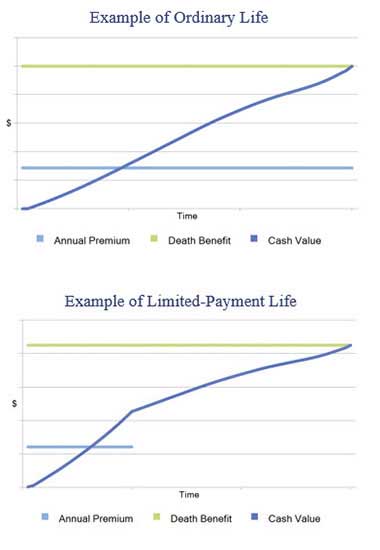

You get death benefits and lump-sum cash that accumulates during the policy period. Limited Pay Life policies such as LP65 and 20-Pay Life are variations of Whole Life or Straight Life. The incremental limited pay life insurance between 10 years and 30 years is able to adjusted or customized depending on WHEN you want to stop.

You can purchase a whole life. The short answer to How Long Does the Coverage normally remain on a limited pay life policy is usually until age 100 or until death. Premiums are usually paid over a period of 10 to 20.

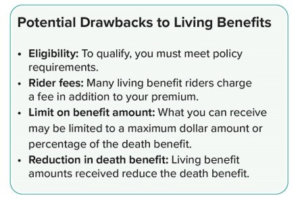

7-pay life insurance life paid up to 65 and. These limited benefit life insurance policies allow you to pay premiums over a period of time usually 10 15 20 or up to age 65 but you get continuous coverage for life. Premiums on limited payment life insurance are paid for a limited number of years but the benefits last a lifetime.

10- or 20- or 25-Pay Whole Life Policies. A limited pay whole life insurance policy is not the right choice for every. The same policy would cost a 65-year-old male roughly 37490 per.

What is a limited-pay life insurance policy. Limited payment whole life insurance covers you for life. The short answer to How Long Does the Coverage normally remain on a limited pay life policy is usually until age 100 or until death.

Limited death benefits restrict the amount of life. Premiums are typically paid over the first 10 to 20 years. When choosing the limited pay whole life option the payment length must be determined at the initial purchase of the policy.

John is a 45-year-old. If youre close to retirement age and are shopping for affordable life insurance a limited-pay life policy may be the best fit for you. A limited pay life insurance policy allows you to pay your insurance premiums in full within a certain time frame.

Because limited pay policies have fewer premiums to reach paid-up status they need more significant premiums yearly than continuous pay insurance policies. The short answer to How Long Does the Coverage normally remain on a limited pay life policy is usually until age 100 or until death. Limited pay policies work well for people who.

Premiums are payable for 10 15 or 20 years depending on the policy. When selecting the limited pay whole life option the payment length must be selected at the time of policy acquisition. A very popular policy currently is a limited pay Index Universal Life or IUL.

A limited-pay life policy requires the policyholder to pay premiums for a limited number of years but its coverage last a lifetime. With a 15-pay whole life insurance policy youll pay for 15 years and.

Limited Pay Whole Life Insurance With Sample Rates For 10 20 Pay

What Is Limited Pay Life Insurance Policyadvisor

Insurance Term Of The Day Limited Payment Whole Life Plan Life Cover Life Plan How To Plan

Whole Life Insurance State Farm

Difference Between Term Insurance And Whole Life Insurance Life Insurance Facts Term Insurance Whole Life Insurance

7 1 Adjustable Life What Is It Flexible Premium Adjustable Death Benefit Type Of Permanent Cash Value Insurance Hybrid Combination Of Universal Ppt Download

Limited Pay Whole Life Insurance Pros And Cons Youtube

Hand In Hand Mutual Fire Life Insurance Companies Whole Of Life Limited Payment Plan This Type Of Plan Is Suitable As Financial Security For Your Dependants And As

Life Insurance Living Benefits Coastal Wealth Management

Comprehensive Guide For Buying A Limited Pay Life Policy

Limited Pay Whole Life Insurance With Sample Rates For 10 20 Pay

How Does Life Insurance Work The Process Overview

Characteristics Of Life Insurance Policies Youtube

What Are Paid Up Additions Pua In Life Insurance

Comprehensive Guide For Buying A Limited Pay Life Policy

The Complete Guide To Life Insurance The Dough Roller

Sec 12 5 Life Insurance Objectives Define Term Ordinary Life Limited Payment And Endowment Life Insurance Policies Understand Universal Life Variable Ppt Download

Should I Cancel My Whole Life Insurance Policy White Coat Investor

Limited Pay Whole Life Insurance With Sample Rates For 10 20 Pay